GRAPHS The new law limiting cash payments would have been the most restrictive in Europe if it came into force / Romania is already in the top 3 when it comes to restrictions / Greece recently dropped a similar project

The new law limiting cash payments would have become, by far, the most severe in Europe, in a context where Romania is already in third place after Greece and France, according to a series of European statistics consulted by G4Media.ro. The Finance Ministry announced on Tuesday, four days before the new limits were due to come into force, that it was abandoning the changes because „Romanian society is not ready at this moment for the limitation of cash use”.

Urmărește cele mai noi producții video G4Media

- articolul continuă mai jos -

Like the Ciolacu government, the Greek government tried to tighten the conditions earlier this year but changed its mind shortly afterward and was even advised by European Central Bank officials to give cash a „breathing space” so as not to destabilize the payments system. Currently, the ceiling in Greece for cash payments is €500 between individuals and companies, and the Greek government wanted to reduce it to €200 to combat tax evasion, just like in Romania.

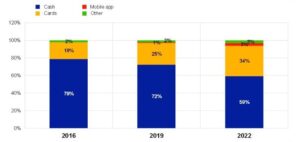

„Cash remains the most commonly used means of payment. More than half of all daily transactions in shops, restaurants, etc. are made with coins and banknotes. In many languages in Europe there are expressions such as ‘cash is king’ and our survey shows that 60% of citizens want to be able to use cash,” reads a text published on the European Central Bank blog.

In Romania, the limit for payments to legal entities is currently 5,000 lei (€1,000) and for the delivery of goods and services 10,000 lei per day (€2,000). Payments between consumers, e.g. for the purchase of a good, a service or for rental, can only be made in cash as long as the amount is less than 50,000 lei (€10,000) per day.

One of the changes to the new law was to reduce the ceiling for cash payments from 5000 lei to 1000 lei (approx 200 euros) from a legal person. „Both the reactions in the public sphere and those in society following the adoption of this measure have led to the conclusion that Romanian society is not ready for the measure limiting the use of cash,” says the explanatory note to an ordinance waiving the limits that were due to enter into force on November 11.

The document also states that in the survey conducted by the National Council of Small and Medium-Sized Private Enterprises in Romania on the reduction of cash payment ceilings from 03-06.11.2023, respondents were opposed to the measures to reduce the ceilings for cash receipts and payments. Thus, out of more than 2,500 entrepreneurs, when asked whether they consider it appropriate to reduce the threshold for cash payments introduced by Law 296/2023 on some fiscal-budgetary measures to ensure Romania’s long-term financial sustainability, 94.1% answered „NO”, according to Economedia.

At the other end of the spectrum, there are a number of countries where there is no limit. To be precise, only 17 out of 28 European countries have cash limits. But the EU wants to reduce these disparities. In particular, as part of the fight against money laundering and terrorist financing, the European Commission has proposed a single limit of €10 000. If the European Parliament agrees, this will be reduced to €7 000, but final negotiations are still ongoing.

The talks come amid fears fuelled by populist political discourse that the European Union wants to abandon cash payments. Initiatives like the cash referendum proposed by the AUR party exist in Austria and Switzerland, and in Slovakia the right to pay cash for services and goods is already part of the constitution.

The major difference is that the AUR does not resort to economic arguments, but to conspiracy theories. The leader of the far-right AUR party, George Simion, told Prima News on 6 November that he does not have a bank card and that he collects his allowance in cash at the parliament and pays everything in cash. He revealed that he would not want anyone who has access to that data to know where he went because it is a matter of principle. The AUR leader also said, according to News.ro, that he had scolded his wife for taking out a credit for an apartment, because if she was initially paying 800 lei, she ended up paying 1,500 lei for the monthly payment. (Read details here)

The European Central Bank (ECB) stresses the importance of cash and that the EU’s intention is to diversify payment methods, not abolish them. „As cash remains widely used and appreciated, we are committed to maintaining euro cash and will continue to ensure that it is available (…).

In addition, we will continue to support the availability of different payment instruments. Compared to a decade or more ago, today’s payment options are much more diverse. To preserve and further develop this diversity, we are working on the possible issuance of a digital euro. This will add another option for citizens to pay with central bank money in addition to cash,” according to the ECB.

Specifically, the ECB announced on October 18 that it was moving into the „preparatory” phase of creating a digital European currency, after two years of investigating what it might look like and how it would be distributed. Banking experts say a national digital currency, i.e. issued by each country’s central bank, would not replace cash payments but complement them. In other words, the two forms of payment would work in parallel. Thus, if the National Bank of Romania (BNR) were to start issuing digital lei tomorrow, they would be convertible into cash lei 1 for 1, PressOne explains in an article.

Donează lunar pentru susținerea proiectului G4Media

Donează suma dorită pentru susținerea proiectului G4Media

CONT LEI: RO89RZBR0000060019874867

Deschis la Raiffeisen Bank